Relocating for a new job is an adventure full of possibilities and hurdles. Imagine packing your bags for a fresh start but with a safety net provided by your employer. In India, many companies offer a relocation allowance to make this transition smoother and stress-free. This blog explains the perks of a relocation allowance in India, unravelling how it operates, who qualifies, and critical factors to remember as you embark on your new journey. Ready to make your move with confidence? Let’s get started!

What is Relocation Allowance?

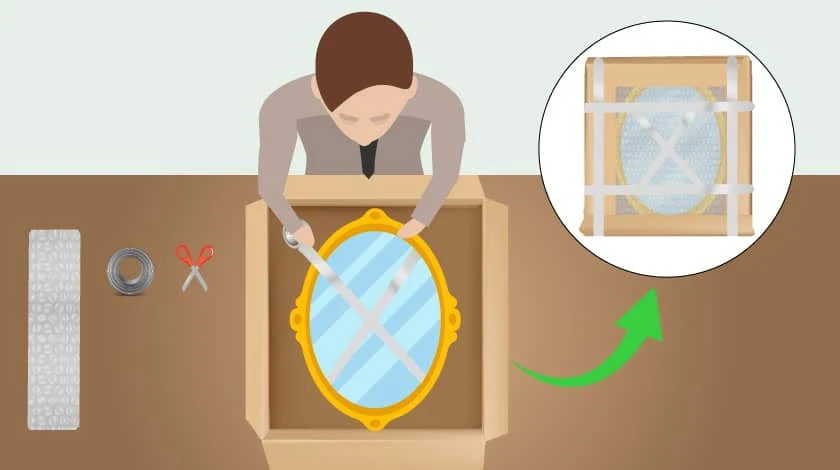

A relocation allowance is an employer’s financial benefit to cover expenses associated with moving to a new location for work. This allowance helps employees manage costs such as packing and moving household goods, transportation, temporary accommodation, and other incidental expenses. The primary goal is to ease the financial burden and stress of relocating, allowing employees to focus on their new role and settling into their new environment.

Company Policies on Relocation Allowance in India

Companies in India have varying policies regarding relocation allowances tailored to meet the specific needs of their employees and business operations. Here are some common elements found in these policies:

1. Coverage of Moving Costs:

- Costs related to packing, transporting, and unpacking household goods.

- Insurance for personal belongings during transit.

2. Transportation Expenses:

- Reimbursement for travel expenses incurred in relocating to the new location will be provided.

- Provision of a company vehicle or allowance for transportation.

3. Temporary Accommodation:

- Costs for temporary housing until permanent accommodation is found.

- Hotel stays or rental properties for a specified duration.

4. Miscellaneous Expenses:

- Reimbursement for expenses such as utility setup, school fees for children, and other incidental costs.

5. House Hunting Trips:

- Expenses for trips to the new location to find suitable housing.

Employee Eligibility and Process for Relocation Allowance

- Eligibility for relocation allowance depends on the company’s policies and the employee’s role. Typically, companies offer this benefit to employees who are:

- Transferred to a different city or region for business needs.

- Hired for key positions that require relocation.

- In roles critical to the company’s operations at the new location.

The process for obtaining a relocation allowance generally involves the following steps:

- Approval:- The HR department or relevant authority reviews and approves the employee’s relocation request.

- Documentation:- The employee submits necessary documents, such as moving cost estimates, travel receipts, and rental agreements.

- Disbursement:- The approved allowance is disbursed to the employee as an advance or reimbursement.

- Monitoring:- The company monitors the expenses to ensure they align with the policy guidelines.

Income Tax Implications on Relocation Allowance

Relocation allowances in India have specific tax implications that employers and employees should be aware of. Generally, the allowance is considered a part of the employee’s taxable income. However, particular components may be exempted from tax, depending on the nature of the expenses and adherence to guidelines set by the Income Tax Department of India.

For example:

- Transportation of Goods: Expenses for household goods may be exempt if they meet the specified conditions.

- Temporary Accommodation: Costs for temporary housing may have tax benefits if they comply with the rules.

Employees are advised to consult with their company’s HR department or a tax consultant to understand the specific tax implications and benefits applicable to their situation.

Exploring Your Relocation Allowance Experience: Important Lessons and Professional Guidance

Relocating for a job can be a smooth and stress-free experience if you understand and utilize your relocation allowance effectively. Here are some key takeaways and expert advice:

- Understand Your Company’s Policy:- Familiarize yourself with your employer’s relocation policy to know what expenses are covered and how to claim the allowance.

- Plan Ahead:- Start planning your move early to avoid last-minute hassles and ensure you have all necessary documents and approvals.

- Keep Detailed Records:- Maintain accurate records of all expenses related to your move, including receipts and invoices, to facilitate smooth reimbursement and tax claims.

- Seek Professional Help:- Consider hiring professional movers and packers to handle the logistics of your move, ensuring your belongings are transported safely and efficiently.

- Consult a Tax Advisor:- Engage with a tax advisor to understand the tax implications of your relocation allowance and optimize your tax benefits.

By leveraging the benefits of relocation allowance, employees in India can easily transition to their new roles and locations, minimizing financial strain and focusing on their professional growth. Relocation allowances are a valuable benefit that supports employees in their journey to new opportunities. Understanding and effectively utilizing this allowance can significantly impact your moving experience, ensuring a smooth and successful transition to your new home and job.

.webp)

.webp)

.webp)

.jpg)

.png)

.png)